Risk Identification and Management Basics Training Course

Course Objectives:

- This will be a one-day course and after the activity the trainees/participants will be able to:

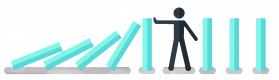

- Define what is a risk, its origin and impact on the business as manifested by their increase awareness on the topic.

- Cite different instances that will be helpful for the organization to limit and, ideally eliminate risk.

- Perform proper forecasting of risk and challenges in a proactive manner.

- Discover numerous techniques to identify, mitigate and limit risk.

- Collaborate with internal channels to strengthen risk management for the organization as a whole.

Training Setup:

- Target Headcount: 10 -20 per batch

- Target Date of Delivery: TBD

- Total Daily Duration: 7 hours duration + 1-hour lunch

- Set-up: Classroom and Presentation Set-up

Methodologies:

- Instructor Led Training

- Role Playing

- Risk Analysis Exercise

- Presentation of Output and Activity Exercises

Hardware and Equipment Needed:

- Projector

- White Board with Writing Materials

- Writing Paraphernalia for Participants

- Sound System/Lapel Mic

- Big Building Blocks/Lego

- Chocolates and other token for activities

- Certificate of Achievement/Completion

Course Outline

| Activity | Description | Time |

| Part 1: Preparation and Registration | Activities include:

| 8:00 AM to 8:30 AM |

| Part 2: Overview of Risk: Its origins, business impact and opportunities for transformation. | A discussion on the nature of risk and its implication on business continuity and existence. This will also cover a little discussion on the impact of change in organization and its influence on risk. | 8:30 AM to 9:45 PM |

| Group Work One: Six Thinking Hats (30 Minutes Activity + 15 Minutes Synthesis) | An exercise to introduce collaborative thinking necessary to ensure idea dissemination. This will be useful in seeing areas of growth, danger and neutrality. | 9:45 AM to 10:30 AM |

| Part 3: Identification of Risk | Introduction of simple quality tools and modalities that could help in the identification of risk through available data (to use MS EXCEL) | 10:30 AM to 12:00 PM |

| Lunch 12:00 PM to 1:00 PM | ||

| Part 4: Discussion on the Risk Management Process | In depth discussion of the risk management process and an introduction to different mechanism of risk mitigation and approaches. Group activities to emphasize process steps will be inculcated in the session. Group activities include:

| 1:00 PM – 4:00 PM |

| Part 5: Maintenance of Action and Governance | Special focus on stakeholder management and gateways of action through daily governance and forecasting of risk. This will include a background of fraud identification, data privacy and protection | 4:00 PM to 5:00 PM |

Requirements

- No prior experience in risk or project management is required

- Interest in understanding and managing workplace or business-related risks

Audience

- Beginners in the field of project and risk management

- Frontline People Leaders

- HR Practitioner

- Individuals with Ideas to start a business

- Frontline Employees

Open Training Courses require 5+ participants.

Risk Identification and Management Basics Training Course - Booking

Risk Identification and Management Basics Training Course - Enquiry

Testimonials (3)

The fact that all the standard was reviewed and discussed with some examples, when needed and required.

Ioana

Course - ISO/IEC 27005 Information Security Risk Management

it was a very good training based on experience

raymond maas - Rhosonics

Course - Chief Technology Officer (CTO) Fundamentals

Hakan was very enthusiastic and knowledgeable

Hugo Perez - DENS Solutions

Course - Project Risk Management

Upcoming Courses

Related Courses

Business English for Non-Native Speakers

14 HoursThis instructor-led, live training in Colombia (online or onsite) is aimed at persons working in an international business environment who wish to quickly improve their listening, speaking and writing skills to be more effective leaders and team members.

By the end of this training, participants will be able to:

- Learn tools and tactics to quickly expand their workplace English vocabulary.

- Focus on only the relevant parts of the English language needed to be more effective at work.

- Gain confidence in their ability to communicate with authority by phone, email and in meetings.

- Practice techniques to influence and persuade customers, managers, and peers.

- Apply a systematic approach to continue improving their Business English skills after the training.

Chief Technology Officer (CTO) Fundamentals

14 HoursThis instructor-led, live training in Colombia (online or onsite) is aimed at current CTOs and upcoming CTOs such as technical directors or technical managers who wish to acquire the technical and managerial perspective needed to be an effective CTO.

By the end of this training, participants will be able to:

- Hire and lead a vibrant and innovative technical team.

- Effectively adopt and manage the technology needed to develop great products.

- Apply useful techniques and strategies for managing products and projects.

- Scale the company business and move it in the right direction.

Digital Marketing in China

14 HoursThis training is best suited for people into Digital Marketing and Strategies.

The training covers the concepts essential to gain traction in China through digital media. It introduces key digital marketing concepts, from mobile marketing and social media marketing to Email marketing, PPC marketing and SEO.

By the end of the training we understand the importance of analytics and good strategy with suitable examples.

Fixed Asset Management and Compliance

14 HoursThis instructor-led, live training in Colombia (online or onsite) is aimed at intermediate-level to advanced-level finance and asset management professionals who wish to optimize asset tracking, control, and compliance with international financial reporting standards (IFRS).

By the end of this training, participants will be able to:

- Classify and configure fixed assets according to IFRS regulations.

- Manage asset creation, acquisition, and capitalization.

- Implement control measures for asset tracking and monitoring.

- Apply appropriate depreciation and amortization methods.

- Process asset movements, transfers, and disposals effectively.

- Ensure compliance with financial reporting and audit standards.

Fixed Assets Management and Control

14 HoursThis instructor-led, live training in Colombia (online or onsite) is aimed at intermediate-level finance and accounting professionals who wish to effectively manage, value, and audit fixed assets in compliance with accounting standards and regulations.

By the end of this training, participants will be able to:

- Understand the life cycle and classification of fixed assets.

- Apply local and international accounting standards in asset valuation and depreciation.

- Manage fixed assets with proper controls, tools, and procedures.

- Comply with legal and tax frameworks relevant to asset management and reporting.

Governance, Risk Management & Compliance (GRC) Fundamentals

21 HoursCourse goal:

To ensure that an individual has the core understanding of GRC processes and capabilities, and the skills to integrate governance, performance management, risk management, internal control, and compliance activities.

Overview:

- GRC Basic terms and definitions

- Principles of GRC

- Core components, practices and activities

- Relationship of GRC to other disciplines

Integrated Risk & Corporate Governance

35 HoursOverview

Across the globe regulators are increasingly linking the amount of risk taken by a bank to the amount of capital it is required to hold and banks and financial services are increasingly being managed on risk-based management practices. The banks, their products, the regulations and the global market are becoming increasingly complex, driving ever greater challenges in effective risk management. A key lesson of the banking crisis of the last five years is that risks are highly integrated and to manage them efficiently banks have to understand these interactions.

Key features include:

- the explanation of the current risk-based regulations

- detailed review of the major risks faced by banks

- industry best practices for adopting an enterprise approach to integrating risk management across an entire organisation

- using governance techniques to build a group wide culture to ensure everyone takes an active role in managing risks in line with the banks strategic objectives

- what challenges could be faced by risk managers in the future.

The course will make extensive use of case studies designed to explore, examine and reinforce the concepts and ideas covered over the five days. Historical events at banks will be used throughout the course to highlight how they have failed to manage their risks and actions that could have been taken to prevent loss.

Objectives

The objective of this course is to help bank management deliver an appropriate integrated strategy for managing the complex and changing risks and regulations in today’s international banking environment. Specifically this course aims to give senior level management an understanding of:

- major risk within the financial industry and the major international risk regulations

- how to manage a bank’s assets and liabilities whilst maximising return

- the interaction between risk types and how banks use an integrated approach for their management

- corporate governance and the best practice approaches to managing the diverse interests of the stakeholders

- how to develop a culture of risk governance as a tool for minimising unnecessary risk taking

Who should attend this seminar

This course is intended those who are new to integrated risk management, senior management responsible strategic risk management, or those who wish to further their understanding of enterprise risk management. It will be of use to:

- Board level bank management

- Senior managers

- Senior risk managers and analysts

- Senior directors and risk managers responsible for strategic risk management

- Internal auditors

- Regulatory and compliance personnel

- Treasury professionals

- Asset and liability managers and analysts

- Regulators and supervisory professionals

- Suppliers and consultants to banks and the risk management industry

- Corporate governance and risk governance managers.

PECB ISO/IEC 27005 Foundation

14 HoursTraining course is focused on the information security risk management process introduced by ISO/IEC 27005 and the structure of the standard.

The course provides an overview of the guidelines of ISO/IEC 27005 for managing information security risks, including context establishment, risk assessment, risk treatment, communication and consultation, recording and reporting, and monitoring and review.

After attending the training course, you can enroll for the Foundation Exam and, if you successfully pass it, you can apply for a “PECB Certificate Holder in ISO/IEC 27005 Foundation” certificate.

Foundation Exam ( extra cost): Duration: 1 hour, Questions: 40, Where: Online

A PECB Foundation certificate shows that you have knowledge on the fundamental concepts, principles, methodologies, processes, and management approaches used in information security risk management.

Project Risk Management

7 HoursThis course is aimed at Project Managers and those interested in Risk Management within Projects.

Problem Solving with Root Cause Analysis (RCA)

14 HoursThis instructor-led, live training in Colombia (online or onsite) is aimed at intermediate-level professionals who wish to develop a systematic approach to identifying, analyzing, and resolving problems using RCA methodologies.

By the end of this training, participants will be able to:

- Understand essential concepts of RCA and continuous improvement cycles.

- Apply different RCA tools to identify the root cause of problems.

- Develop and implement effective problem-solving strategies.

- Integrate RCA into organizational improvement and prevention efforts.

Supply Chain Management in China

14 HoursSCM (Supply Chain Management) refers to the control of activities involved in taking goods and materials from supplier to consumer.

In this instructor-led, live training, participants will learn the fundamentals of SCM as they apply to the China market. This training is aimed at managers who wish to enter the Chinese market. It includes a series of discussions, case studies and exercises to help participants prepare for real-world implementation and practice.

By the end of this training, participants will be able to:

- Understand the dynamics of SCM in China vs SCM in other countries

- Take advantage of China-specific innovations in the supply chain to develop an SCM strategy

- Implement an integrated end-to-end approach to SCM

- Negotiate on price with local suppliers

- Identify key global sourcers and other players in the China supply chain

- Conduct a detailed analysis of common business sourcing problems in China

Audience

- Sourcing Managers

- Persons involved in the SCM process

Format of the course

- Part lecture, part discussion, exercises and hands-on practice